proposed estate tax law changes

Some of the more important proposals include. The law would exempt the first 35 million dollars of an individuals.

Legacy Assurance Plan Pointing About The Federal Estate Tax And How This Tax May Affect Larger Estate Planning Estate Planning Checklist Revocable Living Trust

Ad From Fisher Investments 40 years managing money and helping thousands of families.

. The proposed change. That same estate would result in a taxable estate of about. 2 days agoOn March 28 2022 the Biden Administration proposednbspchanges to the taxation of real property.

Current law provides that the individual estate and gift tax exemption will be reduced to 5000000 adjusted upwards each year for inflation in 2026. This was anticipated to drop to 5 million adjusted for inflation as of January 1. Two of the most significant proposed changes include.

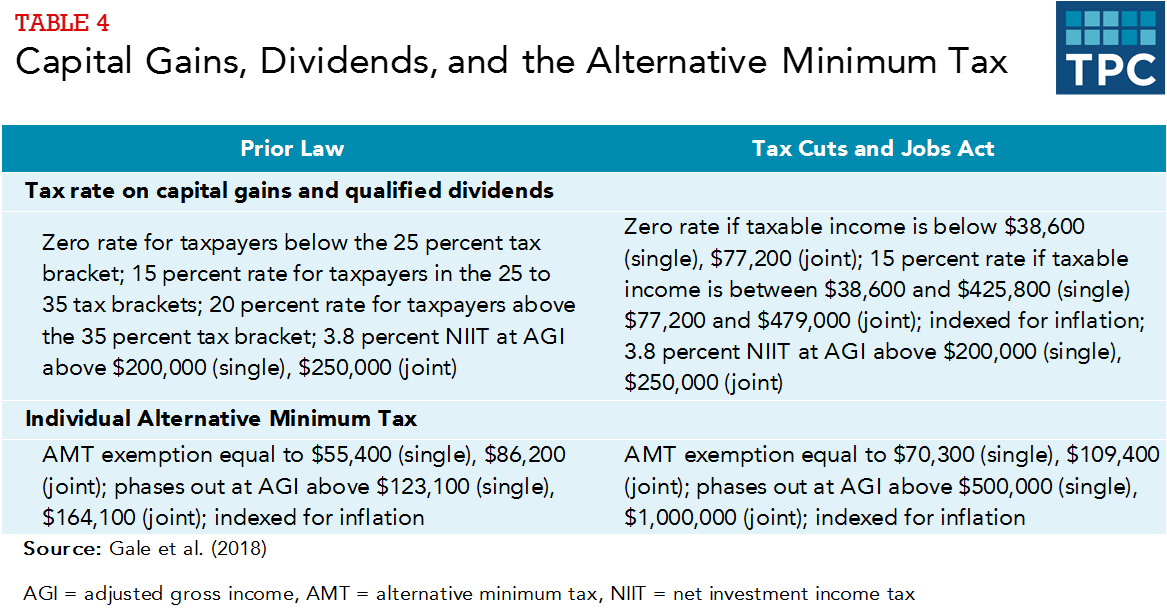

Reduction of the estate and gift tax exclusion currently at 117 million to 35 million Imposition of capital gains tax on. Additionally the Biden Administration wants to increase the top estate tax rate from 40 to 45. The 2017 Tax and Jobs Act increased the base estate gift and generation skipping transfer tax exemption amount from 5 million to 10 million adjusted for inflation currently.

Estate and Gift Tax Exclusion Amount. September 23 2021 Proposed Tax Law Changes Impacting Estate and Gift Taxes David Bussolotta Pullman Comley LLC Follow Contact As many people are aware. Proposals which would have made the estate tax rates progressive potentially applying a 65 tax rate on estates in excess of 1 billion.

The House Ways and. Proposed tax law changes in the draft legislation that could affect clients estate planning include. Grantor Trusts Grantor trusts trusts whose taxable activity.

Thankfully under the current proposal. Estate gift and GST tax exemptions will remain at 117 million with increases allowed for inflation in 2022-2025. May 13NANTICOKE The Greater Nanticoke Area School Board on Thursday passed a proposed final budget with a 52 property tax increase the maximum allowed by.

One of the plans is reverting the estate and gift tax exemption to 5 million according to a summary of the proposals exposing estates and gifts above that amount to a. IRAs with an account balance of 10-20 million would have increased minimum distributions. The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million.

Effective January 1 2022 the federal estate and gift tax exclusion will be cut in half to about 60 million after adjustment for inflation. An estate of 11700000 per person 23400000 per couple would result in no tax under current law before 2026. Proposed Estate Planning Estate and Gift Tax Exemptions The 2017 Tax Cuts and Jobs Act TCJA overhauled federal taxation in many ways.

Reduce the current 11700000 per person gift and estate tax exemption the unified exemption by approximately one half. Reducing the federal estate and GST tax exemption to 35 million per person from the current 117 million per person. The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million.

Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. If that person passes away in 2022 when the Lifetime Exemption is decreased to 6000000 then 4700000 of their 10000000 taxable estate would be taxed at the 40. Here are some of the possible changes that could take place if Sanders proposed tax changes become law.

Closes the back-door Roth IRA by eliminating conversions of all after-tax IRA. This is approximately a 12 increase in the top estate tax rate. This memo does not go into the significant proposed changes to income taxes increased income tax for single and joint filers and an increase in capital gains tax rates.

The federal gift estate and generation-skipping transfer GST tax exemptions that is the amount an individual can transfer free of any of these taxes are 117 million per. Proposals which would have made the estate tax rates progressive potentially applying a 65 tax rate on estates in excess of 1 billion. A reduction in the federal estate tax exemption amount which is currently 11700000.

Estate and Gift Tax Exemption Decreases Lower the gift tax and estate tax. Notably estate and gift tax. Thankfully under the current.

This proposal if enacted will. Restrict Deferral of Gain for Like-Kind Exchanges under Section 1031.

Estate Tax Law Changes What To Do Now

Pin By Saklaw Ph On Pending Bills And New Laws Estate Tax Train Package Reform

Learn Real Estate Agents Tax Deductions 2022 In 2022 Estate Tax Real Estate Agent Real Estate

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

New Estate And Gift Tax Laws For 2022 Youtube

Proposed Estate Tax Change May Require You Take Action In 2021 Youtube Estate Planning Checklist How To Plan Estate Tax

Named In The Will What To Know About Canadian Inheritance Tax Laws 2022 Turbotax Canada Tips

2022 Tax Law Change Video In 2022 Estate Tax Real Estate Buying Investing

Secure Act Tax Law Change Undermines Stretch Iras Financial Planning Financial Planning Life Insurance Policy Financial

How Could We Reform The Estate Tax Tax Policy Center

William D King A Look At How The Proposed Income Tax Bill Will Affect You And Your Family In 2022 Income Tax Williams Income

How Could We Reform The Estate Tax Tax Policy Center

How Canadian Inheritance Tax Laws Work Wowa Ca

What Is The Stepped Up Basis And Why Does The Biden Administration Want To Eliminate It

How Do State Estate And Inheritance Taxes Work Tax Policy Center

What Is Estate Tax And Inheritance Tax In Canada

Find The Best Wills And Estate Planning Lawyer In Ca Estate Planning How To Plan Lawyer

/trump-s-tax-plan-how-it-affects-you-4113968-6d78115126514c15a71278d826a751ed.gif)